The introduction of a tax on sugary drinks in Mexico appears to have helped reduce the consumption of soft drinks after just three years, a study published by The BMJ finds today .

Mexico has some of the highest levels of diabetes, overweight and obesity in the world. Starting January 1, 2014, Mexico implemented a consumption tax of 1 peso per liter (approximately a 10% increase in price) on sugary drinks aimed at reducing consumption.

Since then, studies have shown reductions in household purchases of taxed beverages, but so far no study has looked at individual changes in consumption related to the tax.

So, a team of researchers set out to estimate the change in the probability of consuming soft drinks in a sample of Mexican adults, before and after the implementation of the tax.

Their findings are based on three waves of data (two waves before tax and one wave after tax) on the soft drink consumption of 1,770 adults (average age 47) participating in the Healthcare Workers Cohort Study, a study cohort of health professionals. and their families in Morelos, Mexico, from 2004 to 2018.

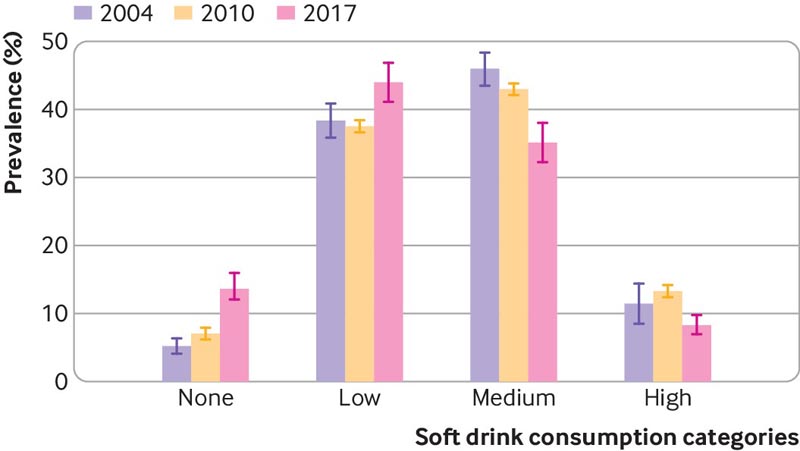

Participants completed a detailed questionnaire about their food and beverage consumption over the previous 12 months, and were placed in one of four soft drink consumption categories (no, low, medium, high).

A nonconsumer consumed no soft drinks, a low consumer consumed less than one serving (355 ml) per week, an average consumer consumed at least one serving per week but less than one serving per day, and a high consumer consumed at least one serving a day.

The researchers then used a statistical model, which adjusted for influential factors such as age, education and income, to estimate the change in the probability of belonging to one of the four categories after the tax was implemented.

The researchers found that after the tax was implemented, the probability of becoming a non-consumer increased by 4.7 percentage points, and the probability of being a low consumer increased by 8.3 percentage points.

Furthermore, the probability of being in the medium and high level of soft drink consumption decreased by 6.8 percentage points for medium consumers and 6.1 percentage points for high consumers.

Stronger associations were observed in participants with secondary education and higher education than in those with primary education or less.

Unadjusted distribution of soft drink consumption categories among participants in the Healthcare Workers Cohort Study between 2004 and 2017. Non-consumer = no soft drink consumption; low consumer = consumed <1 serving/week; average consumer = consumed 1 serving/week to <1 serving/day; high consumer = consumed ≥1 serving/day

Being a cohort of health workers , the results may not reflect the behavior of the entire Mexican population. Additionally, this is an observational study, so it cannot establish causality, and the researchers cannot rule out the possibility that the estimates may be due to other unmeasured factors.

However, their results remained unchanged and the strength of the associations increased after further analysis, suggesting that the findings withstand scrutiny.

As such, they say that taxes on sugary drinks are an effective means of deterring consumption, and suggest that further increases to the tax "could encourage further reductions in very high levels of consumption in Mexico."

They add that more research is needed to understand the long-term implications these changes could have for body weight or metabolic diseases.

Conclusion

Mexico’s sugary drink tax (1 peso per liter) was implemented with the goal of reducing the consumption of unhealthy drinks. Our findings show the continued role that taxes could play in reducing soft drink intake three years after implementation.

More research is needed to understand the long-term implications these changes could have for body weight or metabolic diseases. A growing evidence base suggests that considerable reductions in the consumption of sugary drinks could be achieved with the current tax. There have been recent calls to increase the tax to 20%, to further reduce the consumption of unhealthy drinks.

What is already known about this topic?

What this study adds

|